Introduction

Money makes the world go round—so the saying goes. From ancient bartering systems to modern digital currencies, the evolution of money and trade has been a fascinating journey, reflecting the complexities of human societies and their economies. This article delves into the history of currency, exploring its origins, transformations, and the role it plays in our world today. Buckle up for a journey through time as we uncover the story of how money and trade have evolved.

The Origins of Money

Barter System

Before the invention of money, people relied on the barter system to exchange goods and services. Imagine swapping a bushel of apples for a pair of shoes. While practical in small communities, bartering had its limitations. It required a mutual desire for the goods or services offered, making transactions cumbersome and often inefficient.

Commodity Money

As societies grew, the need for a more efficient system became evident. Enter commodity money—goods with intrinsic value used as a medium of exchange. Items such as cattle, grains, and shells were commonly used. These commodities were valuable and relatively durable, making them suitable for trade.

The Advent of Metal Money

The Use of Metal Objects

The use of metal objects as currency began around 3000 BCE in Mesopotamia. Metals like gold, silver, and copper were valued for their durability, divisibility, and intrinsic worth. They were often shaped into tools, jewelry, and eventually, coins.

The First Coins

The first standardized coins appeared in Lydia (modern-day Turkey) around 600 BCE. These coins were made from electrum, a naturally occurring alloy of gold and silver. The Lydian coinage system marked a significant advancement in the history of money, as it introduced standardized units of value, facilitating trade and economic growth.

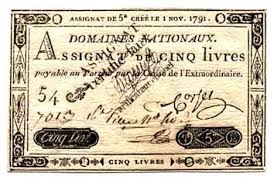

The Rise of Paper Money

Chinese Innovation

The concept of paper money was first introduced in China during the Tang Dynasty (618-907 CE). Due to the inconvenience of carrying heavy metal coins, the Chinese government issued promissory notes, which could be exchanged for a specific amount of precious metal. This innovation revolutionized trade by making transactions more convenient and efficient.

Paper Money in Europe

Paper money took longer to catch on in Europe. It wasn’t until the 17th century that the Bank of England began issuing banknotes. These notes were initially receipts for deposits of gold and silver but eventually became widely accepted as a medium of exchange in their own right.

The Gold Standard

Establishing the Gold Standard

By the 19th century, many countries adopted the gold standard, where the value of a country’s currency was directly linked to a specific amount of gold. This system provided stability and confidence in the currency, as it guaranteed that banknotes could be exchanged for gold at a fixed rate.

The Demise of the Gold Standard

The gold standard began to crumble during the 20th century, particularly during the Great Depression and World War II. The financial strain and the need for greater flexibility in monetary policy led to its eventual abandonment. In 1971, the United States officially ended the convertibility of the dollar to gold, marking the end of the gold standard era.

The Rise of Fiat Currency

Understanding Fiat Money

With the gold standard gone, fiat money became the norm. Unlike commodity money, fiat money has no intrinsic value; its worth is derived from the trust and confidence of the people who use it. Governments issue fiat currency, which is backed by the state’s authority rather than a physical commodity like gold or silver.

Advantages and Disadvantages

Fiat currency offers greater flexibility in monetary policy, allowing governments to manage the economy through mechanisms like interest rates and money supply. However, it also carries risks, such as inflation and devaluation, if not managed properly.

The Birth of Modern Banking

The Medici Bank

The Medici Bank, established in the 14th century in Florence, Italy, played a pivotal role in the development of modern banking. The Medici family pioneered techniques such as double-entry bookkeeping and letters of credit, which facilitated international trade and finance.

The Role of Central Banks

Central banks, such as the Bank of England and the Federal Reserve, emerged to oversee monetary policy and regulate the banking system. These institutions play a crucial role in maintaining economic stability, managing inflation, and acting as lenders of last resort during financial crises.

The Advent of Digital Currency

The Rise of Credit and Debit Cards

The late 20th century saw the rise of credit and debit cards, revolutionizing the way people make transactions. These cards provide a convenient and secure method of payment, reducing the need for physical cash and simplifying financial management.

The Emergence of Cryptocurrencies

In the 21st century, cryptocurrencies emerged as a new form of digital currency. Bitcoin, created in 2009 by an anonymous person or group known as Satoshi Nakamoto, was the first decentralized cryptocurrency. Cryptocurrencies leverage blockchain technology to ensure secure and transparent transactions without the need for intermediaries.

The Impact of Digital Wallets

Digital wallets, such as PayPal, Apple Pay, and Google Wallet, have further transformed the landscape of money and trade. These platforms enable users to make payments, transfer funds, and manage their finances using smartphones and other digital devices.

The Globalization of Trade

The Silk Road

The Silk Road was an ancient network of trade routes that connected the East and West, facilitating the exchange of goods, culture, and ideas. It played a crucial role in the development of trade and commerce, linking civilizations and fostering economic growth.

The Age of Exploration

The Age of Exploration, spanning the 15th to the 17th centuries, saw European powers embark on voyages to discover new trade routes and territories. This period marked the beginning of global trade and the exchange of goods, such as spices, silk, and precious metals, on an unprecedented scale.

The Industrial Revolution

The Industrial Revolution, which began in the 18th century, further accelerated global trade. Advances in transportation, such as the steam engine and railways, and innovations in manufacturing, such as the assembly line, revolutionized production and distribution. This period marked the rise of industrial capitalism and the expansion of international markets.

Also Read What Happened to Yahoo? From Internet Pioneer to Fallen Giant

The Evolution of Trade Agreements

The General Agreement on Tariffs and Trade (GATT)

The General Agreement on Tariffs and Trade (GATT), established in 1947, aimed to reduce trade barriers and promote international trade. It provided a framework for negotiating trade agreements and resolving disputes among member countries.

The World Trade Organization (WTO)

In 1995, the World Trade Organization (WTO) was established to replace GATT. The WTO serves as a global forum for trade negotiations, enforcement of trade agreements, and resolution of trade disputes. It plays a crucial role in promoting free and fair trade on a global scale.

The Future of Money and Trade

The Rise of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are digital versions of a country’s fiat currency, issued and regulated by the central bank. CBDCs aim to combine the benefits of digital payments with the stability and trust of traditional fiat currency. Several countries, including China and Sweden, are already exploring or piloting CBDCs.

The Impact of Blockchain Technology

Blockchain technology, the foundation of cryptocurrencies, has the potential to revolutionize various aspects of trade and finance. Its decentralized and transparent nature can enhance security, reduce fraud, and streamline processes such as supply chain management and cross-border payments.

Sustainable and Inclusive Trade

The future of trade will likely focus on sustainability and inclusivity. Efforts to address environmental concerns, such as reducing carbon emissions and promoting green technologies, will shape global trade policies. Additionally, initiatives to ensure that trade benefits all segments of society, particularly marginalized and disadvantaged communities, will be crucial for achieving equitable growth.

Conclusion

The evolution of currency and trade is a testament to human ingenuity and adaptability. From the early barter systems to the digital currencies of today, money has continuously transformed to meet the needs of societies and economies. As we move forward, the future of money and trade will be shaped by technological advancements, global cooperation, and a commitment to sustainability and inclusivity. Understanding the history of currency and trade provides valuable insights into the complexities of our modern world and the challenges and opportunities that lie ahead.

FAQs

1. What was the first form of currency?

The first forms of currency were commodity money, such as cattle, grains, and shells, which had intrinsic value and were used as a medium of exchange.

2. How did paper money originate?

Paper money originated in China during the Tang Dynasty (618-907 CE) as promissory notes that could be exchanged for a specific amount of precious metal. It later spread to Europe in the 17th century.

3. What is fiat currency?

Fiat currency is a type of money that has no intrinsic value but is backed by the authority of the government that issues it. Its value is derived from the trust and confidence of the people who use it.

4. How do cryptocurrencies work?

Cryptocurrencies use blockchain technology to ensure secure and transparent transactions. They operate independently of central banks and rely on cryptographic algorithms to verify and record transactions.

5. What are Central Bank Digital Currencies (CBDCs)?

Central Bank Digital Currencies (CBDCs) are digital versions of a country’s fiat currency, issued and regulated by the central bank. CBDCs aim to combine the benefits of digital payments with the stability and trust of traditional fiat currency.