Remember the beanie babies craze? Or those clunky Tamagotchi keychains everyone clipped to their backpacks? Fads come and go, leaving us with a pile of “what were we thinking?” memories. But what about cryptocurrency? Is it the revolutionary future of finance, or just another passing fad destined to fizzle out?

Cryptocurrency (or crypto, for short) has taken the world by storm. From Bitcoin’s meteoric rise to the ever-expanding universe of altcoins, digital currencies are sparking curiosity and controversy alike. But with its volatile swings and complex nature, it’s easy to feel lost in the crypto jungle.

Fear not, intrepid explorer! This guide will equip you with the knowledge to navigate the world of cryptocurrency, separating fact from fiction and helping you decide if it’s a worthy addition to your financial portfolio.

Demystifying the Digital: What Exactly is Cryptocurrency?

Unlike traditional currencies printed by governments, cryptocurrency exists solely in the digital realm. It’s secured by cryptography, a complex system of codes that ensures the authenticity and security of each digital coin.

Here’s a breakdown of the key features of cryptocurrency:

- Decentralized: It isn’t controlled by any central bank or authority. Transactions are recorded on a public ledger called a blockchain, accessible to anyone on the network.

- Secure: Cryptography safeguards transactions, making them nearly impossible to counterfeit or manipulate.

- Borderless: It transcends geographical borders, allowing for fast and cheap international transactions.

- Pseudonymous: While transactions are publicly recorded, user identities are typically masked, offering a degree of anonymity.

Imagine a global, digital cash system, free from centralized control and accessible to anyone with an internet connection. That’s the core idea behind It.

The Rise of the Coins: A Brief History of Cryptocurrency

The story of cryptocurrency starts with Bitcoin, the first and most well-known digital currency, launched in 2009 by the mysterious Satoshi Nakamoto (whose true identity remains unknown). Bitcoin’s success paved the way for a surge of new cryptocurrencies, known as altcoins, catering to diverse needs and functionalities.

Fast forward to today, and the cryptocurrency landscape is a vibrant ecosystem with thousands of digital coins vying for attention.

The Allure and the Anxieties: Exploring the Pros and Cons of Cryptocurrency

Cryptocurrency presents a unique set of advantages and disadvantages to consider:

Pros:

- Decentralization: Freedom from central control empowers users and fosters transparency.

- Security: Cryptography safeguards transactions, minimizing the risk of fraud.

- Accessibility: Anyone with an internet connection can participate in the crypto economy.

- Fast and Cheap Transactions: It enables quick and inexpensive international transactions.

- Potential for High Returns: The value of some cryptocurrencies has skyrocketed, offering lucrative investment opportunities (though with high risk).

Cons:

- Volatility: The value of crypto can fluctuate wildly, making it a risky investment.

- Regulation: The regulatory landscape surrounding crypto is still evolving, creating uncertainty.

- Security Risks: Crypto exchanges and wallets can be vulnerable to hacking.

- Environmental Impact: The energy consumption required to mine some cryptocurrencies raises environmental concerns.

- Limited Adoption: Widespread acceptance of crypto for everyday purchases is still limited.

Think of crypto as a high-octane investment vehicle. It offers the potential for significant gains, but comes with a bumpy ride and a hefty dose of risk.

Beyond the Buzz: Is Cryptocurrency the Future of Money?

The future of cryptocurrency remains shrouded in a veil of uncertainty. Here are some potential scenarios:

- Mainstream Adoption: Cryptocurrency could become a widely accepted form of payment, used for everyday transactions.

- Regulation and Integration: Governments may establish regulations around cryptocurrency, integrating it into traditional financial systems.

- A Niche Market: Cryptocurrency might remain a niche market for tech enthusiasts and investors seeking high-risk, high-reward opportunities.

The truth? Only time will tell. Cryptocurrency has the potential to revolutionize finance, but it faces significant challenges that need to be addressed.

Investing in Crypto: A Few Words of Caution (Before You Take the Plunge)

Tempted to jump on the crypto bandwagon? Here are some crucial things to consider before investing:

- Do Your Research: Understand the technology, the risks involved, and the specific cryptocurrency you’re considering.

- Start Small: Only invest what you can afford to lose.

- Diversify Your Portfolio: Cryptocurrency should be a small portion of your overall investment strategy.

- Beware of Hype and Scams: The crypto market is rife with scams. Don’t invest based on hype or promises of guaranteed returns.

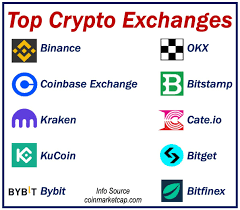

- Security is Paramount: Choose reputable crypto exchanges and wallets with robust security measures. Store your passwords securely and never share them with anyone.

Remember: It is a complex and volatile market. Invest responsibly and with a healthy dose of caution.

The Future Unfolds: Preparing for a Crypto-Influenced World

Whether it becomes the dominant form of payment or remains a niche market, it’s undeniable that it’s influencing the future of finance. Here’s how you can prepare for a crypto-influenced world:

- Stay Informed: Keep up-to-date with the latest developments in the crypto space.

- Embrace New Technologies: Educate yourself on blockchain technology and other innovations driving the crypto revolution.

- Consider Small-Scale Integration: Explore options for using it for everyday purchases, if available in your region.

By familiarizing yourself with It, you’ll be better equipped to navigate the evolving financial landscape and make informed decisions about its potential role in your life.

Conclusion: Cryptocurrency – A Journey, Not a Destination

Cryptocurrency is a fascinating experiment in digital money. While its future remains uncertain, it’s undeniable that it’s shaking up the traditional financial system. Whether you choose to invest or simply observe, understanding it will equip you to participate in, or at least understand, the exciting (and sometimes bewildering) world of digital finance.

Read Also

- Is AI a Threat to Human Jobs or an Opportunity for Growth?

- Signs you’re in a toxic relationship

- The Hidden Math of Time: Unveiling the Base 60 System

- The Evolution of Technology: From the Telegraph to the Smartphone

Frequently Asked Questions (FAQs)

1. Is cryptocurrency legal?

The legality of cryptocurrency varies depending on the jurisdiction. While it’s not illegal to own it in most countries, some governments have placed restrictions on its use.

2. How do I buy cryptocurrency?

You can buy it on crypto exchanges using traditional currency like USD or EUR. Always choose reputable and secure exchanges.

3. How do I store cryptocurrency?

It is stored in digital wallets. There are different types of wallets, each with varying security features. Research and choose a wallet that suits your needs.

4. What are the environmental concerns surrounding cryptocurrency?

Mining some cryptocurrencies requires significant computing power, leading to high energy consumption. This raises concerns about the environmental impact.

5. Should I invest in crypto?

It is a high-risk, high-reward investment. Only invest what you can afford to lose and conduct thorough research before making any investment decisions.