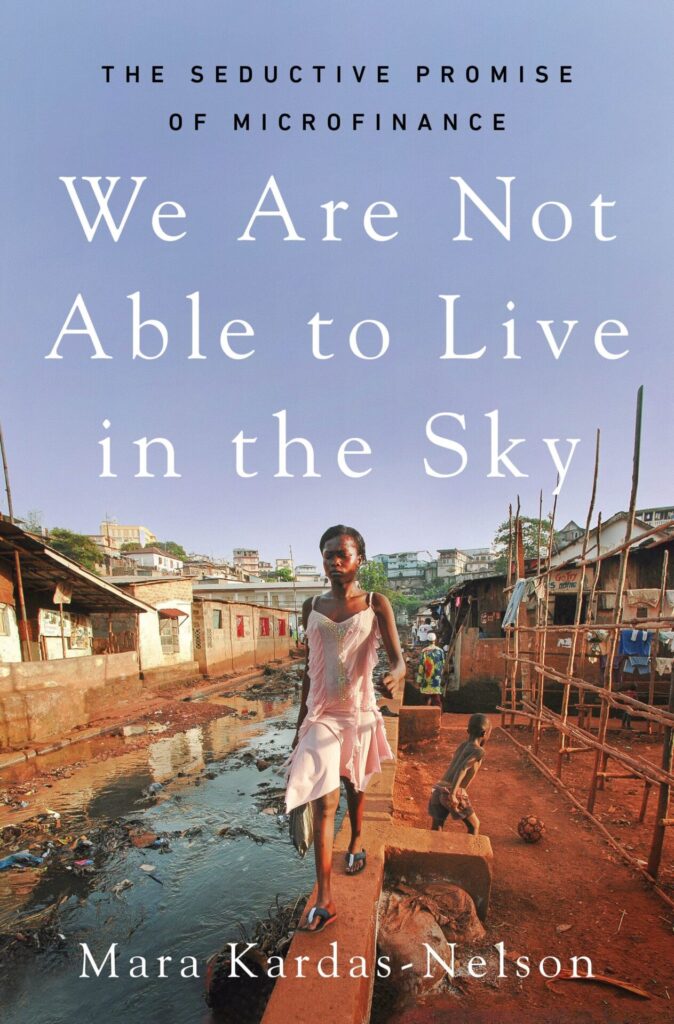

We Are Not Able to Live in the Sky: The Unraveling Promise of Microfinance

In “We Are Not Able to Live in the Sky,” Mara Kardas-Nelson presents a critical examination of microfinance, a financial model that has been heralded as a solution to poverty but has often failed to deliver on its promises. Through deeply immersive narratives of women borrowers in Sierra Leone, Kardas-Nelson reveals the unintended consequences of microcredit, and the harsh realities faced by those who rely on it. The book serves as a poignant exploration of optimism, systemic inequality, and the complexities of international development, challenging readers to reconsider the efficacy of quick-fix solutions in addressing deep-rooted social issues.

Main Characters

While “We Are Not Able to Live in the Sky” is a nonfiction work, it features several key figures and groups that play significant roles in the narrative:

1. Mara Kardas-Nelson

As the author and investigative journalist, Kardas-Nelson brings her expertise in international development to the forefront. Her narrative is driven by her commitment to uncovering the realities of microfinance and its impact on women’s lives in Sierra Leone.

2. Women Borrowers

The heart of the book lies in the stories of women who take out microfinance loans in Sierra Leone. Through their personal experiences, Kardas-Nelson illustrates the challenges they face, including high-interest rates, debt cycles, and the pressure to repay loans. These women serve as powerful voices that highlight the human cost of microfinance.

3. International Development Workers

Kardas-Nelson introduces various international development workers, funders, and advocates who champion microfinance as a solution to poverty. Their perspectives provide insight into the motivations behind promoting microcredit and the disconnect between their intentions and the realities on the ground.

4. Muhammad Yunus

The book references Muhammad Yunus, the Bangladeshi economist who pioneered the concept of microfinance and won the Nobel Peace Prize for his efforts. His vision of using small loans to empower the poor serves as a backdrop for the narrative, illustrating how the initial promise of microfinance has evolved into a complex and often problematic industry.

Key Events and Plot

“We Are Not Able to Live in the Sky” unfolds through a series of thematic explorations rather than a linear plot. Key events include:

1. The Rise of Microfinance

Kardas-Nelson begins by tracing the origins of microfinance, highlighting its rapid rise in popularity during the early 2000s. She discusses how microcredit was marketed as a revolutionary solution to poverty, with endorsements from celebrities and policymakers, creating a narrative that suggested small loans could transform lives.

2. Personal Stories of Borrowers

The narrative shifts to the personal stories of women in Sierra Leone who have taken out microfinance loans. Kardas-Nelson provides intimate portraits of their lives, detailing the struggles they face in repaying high-interest loans while trying to support their families. These stories reveal the harsh realities of living in poverty and the emotional toll of debt.

3. Unintended Consequences

Kardas-Nelson explores the unintended consequences of microfinance, including the cycle of debt that many borrowers find themselves trapped in. She presents evidence that, contrary to the promises of empowerment, many women are worse off after taking out loans. This section highlights the disconnect between the idealistic vision of microfinance and the lived experiences of borrowers.

4. Critique of the Microfinance Industry

The book delves into a critical examination of the microfinance industry, questioning who benefits from these loans. Kardas-Nelson discusses the profit motives of microfinance institutions, and the high-interest rates charged to borrowers, raising ethical concerns about the sustainability of the model. She emphasizes the need for a more nuanced understanding of the complexities involved in poverty alleviation.

5. Voices of Activism and Change

In the latter part of the book, Kardas-Nelson highlights the voices of activists and organizations advocating for more equitable solutions to poverty. She presents alternative models that prioritize living-wage jobs and sustainable economic development over high-interest loans. This section serves as a call to action for readers to reconsider the effectiveness of microfinance as a solution to poverty.

Themes

1. The Illusion of Empowerment

A central theme of “We Are Not Able to Live in the Sky” is the illusion of empowerment that microfinance presents. Kardas-Nelson illustrates how the narrative surrounding microcredit often overlooks the systemic issues that perpetuate poverty, leading to a cycle of debt rather than genuine empowerment.

2. Systemic Inequality

The book addresses the systemic inequalities that underpin the microfinance model. Kardas-Nelson emphasizes that without addressing the root causes of poverty, such as lack of access to education and living-wage jobs, microfinance can exacerbate existing disparities rather than alleviate them.

3. Human Cost of Debt

Kardas-Nelson highlights the human cost of debt through the personal stories of women borrowers. The emotional and psychological toll of repaying loans becomes a focal point, illustrating the profound impact of financial systems on individuals’ lives.

4. Reimagining Solutions to Poverty

The narrative advocates for reimagining solutions to poverty that prioritize sustainability and equity. Kardas-Nelson emphasizes the importance of listening to the voices of those directly affected by poverty and considering alternative approaches that address the complexities of economic development.

Conclusion

“We Are Not Able to Live in the Sky” by Mara Kardas-Nelson is a powerful and thought-provoking exploration of the microfinance industry and its impact on women in Sierra Leone. Through deeply immersive narratives and critical analysis, Kardas-Nelson challenges the prevailing narrative that microcredit is a panacea for poverty, revealing the complexities and unintended consequences of this financial model.

The book serves as a poignant reminder of the importance of understanding the human experiences behind policy decisions and the need for more equitable solutions to poverty. By amplifying the voices of women borrowers and critiquing the microfinance industry, Kardas-Nelson encourages readers to engage critically with the narratives that shape our understanding of development.

Ultimately, “We Are Not Able to Live in the Sky” calls for a reevaluation of our approaches to poverty alleviation, urging us to prioritize sustainable solutions that empower individuals and communities. As we confront the challenges of inequality and economic injustice, Kardas-Nelson’s work serves as a vital contribution to the ongoing dialogue about the future of international development and the responsibility we share in creating a more just world.

Read Full Novel

We Are Not Able to Live in the Sky

Read Related Novels

- Read Vector by Robyn Arianrhod eBook Review

- Read The Singularity Is Nearer by Ray Kurzweil Summary

- Read Becoming Earth by Ferris Jabr Summary

- Read Frostbite by Nicola Twilley eBook Review

- Read Sing Like Fish by Amorina Kingdon eBook Review

- Read Vector by Robyn Arianrhod eBook Review

- Read On Call by Anthony Fauci eBook Review