Introduction

Hey there, number crunchers! In today’s fast-paced digital world, the life of an accountant is more tech-driven than ever. Gone are the days of ledger books and manual calculations. Instead, software has become the backbone of accounting, making processes faster, more accurate, and way less tedious. But with so many options out there, which tools are truly indispensable? Buckle up as we dive into the top 5 software every accountant should know how to use. Whether you’re a seasoned CPA or just starting out, mastering these tools will supercharge your efficiency and help you stay ahead in the game.

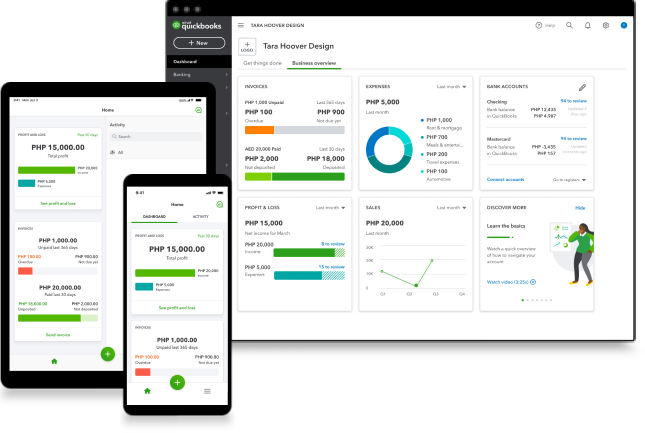

1. QuickBooks: The All-Around Powerhouse

Why QuickBooks Is Essential

QuickBooks is a household name in the accounting world, and for good reason. It’s incredibly versatile, catering to small businesses, freelancers, and even larger enterprises. The software offers robust features for bookkeeping, invoicing, payroll, and tax preparation, making it a one-stop shop for many accounting needs.

Key Features

- User-Friendly Interface: QuickBooks is designed with the user in mind. Its intuitive interface makes it easy to navigate, even for those who aren’t tech-savvy.

- Invoicing and Payments: Creating and sending invoices is a breeze. Plus, you can track payments and even set up automatic reminders for clients.

- Expense Tracking: Link your bank accounts and credit cards to automatically import and categorize expenses, saving you hours of manual entry.

- Reporting: Generate a variety of reports to get insights into your financial health. From profit and loss statements to balance sheets, QuickBooks has you covered.

Getting Started with QuickBooks

Ready to dive in? Start by setting up your company profile and linking your financial accounts. Spend some time exploring the dashboard and getting familiar with the main features. There are plenty of tutorials available to help you get up to speed quickly.

2. Microsoft Excel: The Accountant’s Swiss Army Knife

Why Excel Is Still Relevant

Despite the rise of specialized accounting software, Excel remains a critical tool for accountants. Its flexibility and powerful data manipulation capabilities make it invaluable for a wide range of tasks, from budgeting to financial analysis.

Key Features

- Formulas and Functions: Excel’s extensive library of formulas and functions allows you to perform complex calculations with ease. Whether it’s SUMIF, VLOOKUP, or pivot tables, mastering these can dramatically improve your efficiency.

- Data Visualization: Create charts and graphs to visualize data and uncover trends. This can be particularly useful when presenting information to clients or stakeholders.

- Macros: Automate repetitive tasks with macros. This feature can save you a significant amount of time, especially when dealing with large datasets.

- Templates: Use or create templates for various accounting tasks, such as budget tracking, financial statements, and expense reports.

Getting Started with Excel

If you’re new to Excel, start with the basics. Familiarize yourself with common formulas and functions, then move on to more advanced features like pivot tables and macros. There are countless resources online, including tutorials and courses, to help you become an Excel wizard.

3. Xero: Cloud Accounting for Modern Businesses

Why Xero Stands Out

Xero is another heavy hitter in the accounting software arena, especially popular among small to medium-sized businesses. Its cloud-based nature means you can access your financial data from anywhere, anytime. This flexibility is a game-changer for accountants who need to stay connected on the go.

Key Features

- Real-Time Collaboration: Xero allows multiple users to access and work on the same financial data simultaneously. This is perfect for accountants who need to collaborate with clients or team members.

- Bank Reconciliation: Xero automatically imports and categorizes your bank transactions, simplifying the reconciliation process.

- Invoicing: Create professional invoices quickly and easily. You can also set up recurring invoices and automatic payment reminders.

- Payroll: Xero’s payroll feature integrates seamlessly with its accounting functions, streamlining the process of paying employees and managing taxes.

Getting Started with Xero

To get started with Xero, sign up for an account and set up your organization’s details. Link your bank accounts and explore the dashboard to get a feel for the software. Take advantage of Xero’s extensive library of tutorials and webinars to become proficient in no time.

4. Sage 50cloud: Robust Accounting for Growing Businesses

Why Sage 50cloud Is a Contender

Sage 50cloud, formerly known as Peachtree, combines the reliability of desktop software with the flexibility of the cloud. It’s particularly well-suited for growing businesses that need a scalable accounting solution with advanced features.

Key Features

- Advanced Inventory Management: Sage 50cloud offers detailed inventory tracking and management features, making it ideal for businesses with complex inventory needs.

- Job Costing: Track costs associated with specific jobs or projects, helping you stay on budget and improve profitability.

- Comprehensive Reporting: Generate detailed financial reports to gain insights into your business performance. Customize reports to meet your specific needs.

- Integration with Microsoft 365: Sage 50cloud integrates seamlessly with Microsoft 365, enhancing productivity and collaboration.

Getting Started with Sage 50cloud

Begin by setting up your company profile and configuring your financial settings. Link your bank accounts and import any existing financial data. Spend some time exploring the inventory and job costing features, as these can significantly enhance your accounting capabilities.

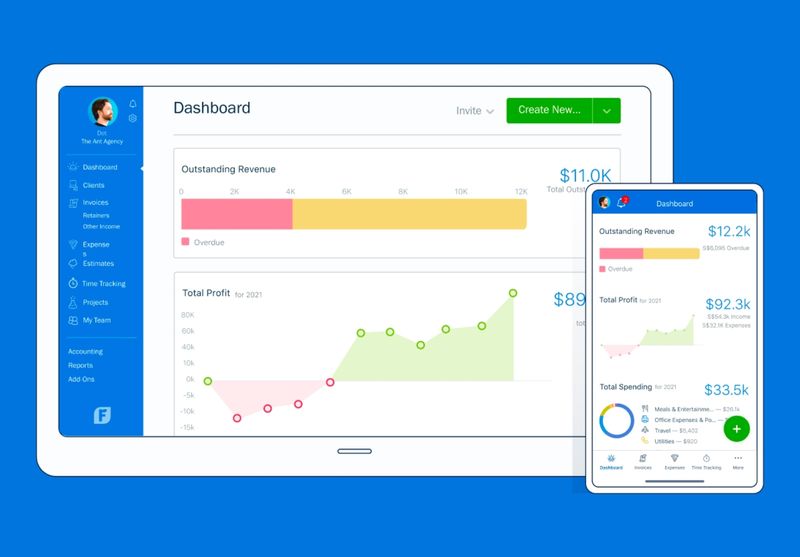

5. FreshBooks: Streamlined Accounting for Freelancers and Small Businesses

Why FreshBooks Is Ideal for Freelancers

FreshBooks is designed with freelancers and small business owners in mind. Its straightforward, user-friendly interface makes it easy to manage invoicing, expenses, and time tracking without getting bogged down in complexity.

Key Features

- Invoicing: Create and send professional invoices in minutes. FreshBooks also offers automated payment reminders and recurring invoices.

- Expense Tracking: Snap photos of receipts and log expenses on the go. FreshBooks categorizes expenses automatically, saving you time.

- Time Tracking: Track billable hours with ease. FreshBooks’ time tracking feature integrates with its invoicing, ensuring you get paid for every minute worked.

- Client Management: Manage client information and communication in one place, making it easy to keep track of your business relationships.

Getting Started with FreshBooks

Sign up for a FreshBooks account and set up your profile. Create your first invoice and familiarize yourself with the expense tracking and time tracking features. FreshBooks offers a variety of resources, including tutorials and customer support, to help you get the most out of the software.

Integrating Accounting Software: Making Your Tools Work Together

The Power of Integration

Using multiple software solutions can be overwhelming, but integrating them can streamline your workflow and enhance productivity. Most accounting software offers integrations with other tools, such as CRM systems, payroll services, and payment processors.

Tips for Effective Integration

- Identify Your Needs: Determine which integrations will be most beneficial for your business. Focus on tools that will save you time and improve efficiency.

- Use APIs: Many software solutions offer APIs (Application Programming Interfaces) that allow you to connect different tools seamlessly.

- Automate Where Possible: Look for opportunities to automate repetitive tasks, such as data entry or report generation, by integrating your software.

The Future of Accounting Software

AI and Machine Learning

Artificial intelligence (AI) and machine learning are transforming accounting software. These technologies can automate complex tasks, provide predictive analytics, and even detect fraud. Staying updated on these advancements will keep you ahead of the curve.

Blockchain Technology

Blockchain offers the potential for more secure and transparent financial transactions. As this technology becomes more mainstream, it could revolutionize the way we handle accounting and auditing.

Cloud Computing

The shift to cloud-based solutions is only accelerating. Cloud computing offers flexibility, scalability, and cost savings, making it an attractive option for businesses of all sizes.

Conclusion

There you have it—the top 5 software every accountant should know how to use. From the versatility of QuickBooks to the specialized features of FreshBooks, mastering these tools will enhance your efficiency and help you stay competitive in the ever-evolving world of accounting. Embrace the power of technology, and watch your accounting prowess soar to new heights!

Read Related Posts

How to Sell Your Products on Jumia: A Step-by-Step Guide

Affiliate Marketing: What It Is and How to Get Started

Upwork vs. Fiverr: Which Platform is Best for Freelancers?

FAQs

QuickBooks is widely regarded as the best accounting software for small businesses due to its versatility, user-friendly interface, and robust feature set.

Yes, many accounting software solutions offer integrations with other tools, such as CRM systems and payment processors, to streamline workflows and improve efficiency.

Absolutely! Excel remains a critical tool for accountants due to its powerful data manipulation capabilities and flexibility.

Cloud-based accounting software offers flexibility, scalability, and cost savings, allowing you to access your financial data from anywhere and collaborate in real-time.

AI can automate complex tasks, provide predictive analytics, and detect fraud, making accounting processes more efficient and accurate.

awesome 😎